Growthix Capital

M&A advisory

Growthix Capital is one of Japan’s largest independent M&A firms and since our establishment in 2019, we have advised on numerous mergers and acquisitions across industries.

Growthix Investment

fund management

Growthix Investment is a dedicated private equity fund strategically focusing on the enablement of the Search Fund Framework within the Japanese market.

NextPreneur University

cultivating next-generation entrepreneurs

NextPreneur University is a one-of-a-kind business school that seeks to cultivate and produce the next-generation entrepreneurs (i.e., the “NextPreneurs” or searchers) who will inherit and carry-on businesses.

About the Growthix Group

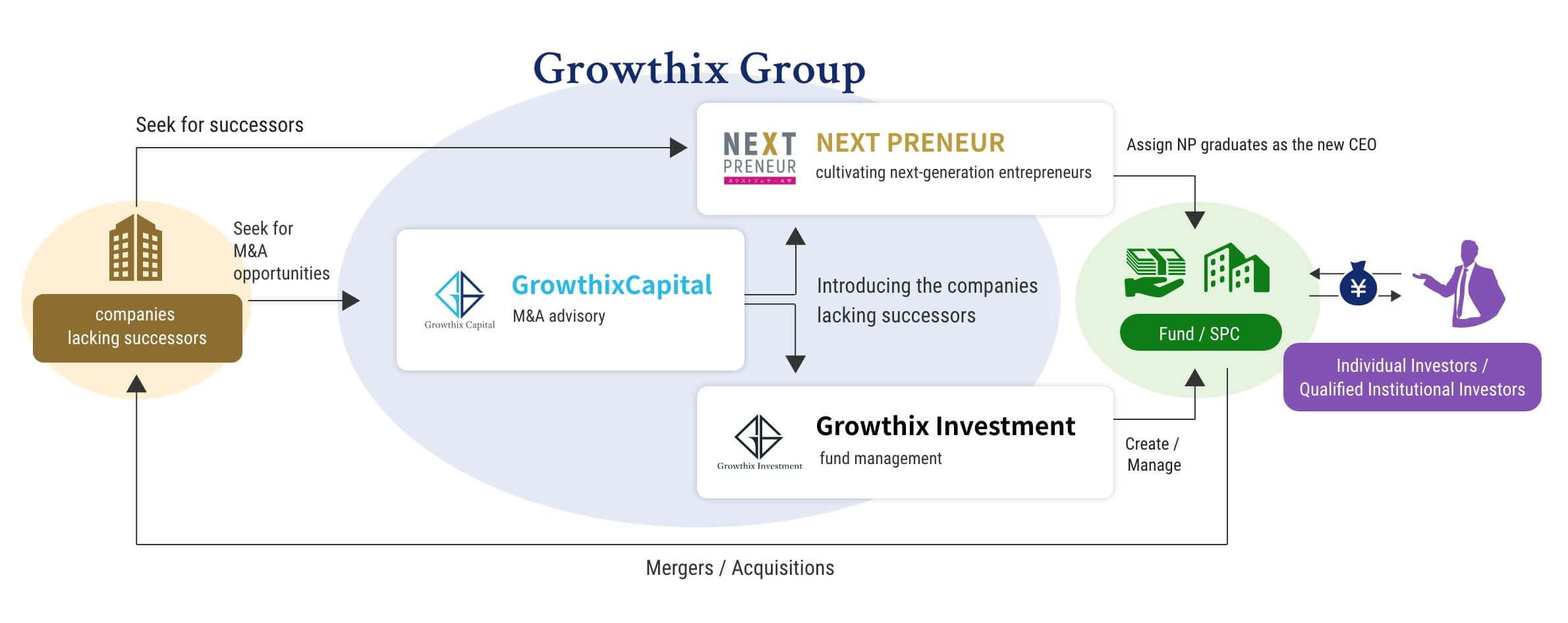

The Growthix Group has been pioneering support for search funds in Japan.

In order to create profitable and sustainable search funds,

it is essential to match the target company with the optimal successor and funding.

Growthix Group is the only company in Japan that has the self-contained capabilities to support all three of these axes.

Primarily through:

Cultivating searchers (successors) at NextPreneur University

Providing funding for search funds

Finding target (i.e., selling) companies that need a successor and providing comprehensive M&A advisory service

Smooth collaboration between each function within the Growthix group is the reason

why we continue to grow as the premier search fund supporting company in Japan.

What is a Japanese-style search fund?

Originating from the United States, search funds are an investment model in which investors financially support entrepreneur’s efforts to locate (or “search”), acquire, manage, grow, and exit a privately held company.

Since the model was found in 1984, several hundred search funds have been established around the world.

Although we are also actively engaged with the establishment of traditional search funds as well (i.e. the model introduced in the Stanford Study where entrepreneurs; typically MBA graduated searchers raise search capital from a group of investors), we also believe that there are limits to the traditional model given Japan-specific conditions.

[Distinguishing characteristics of Japan]

1.There is a shortage of talent (e.g. MBA graduates) capable of taking over management at companies lacking successors

2. The idea of investing in individual entrepreneurs has not taken root in Japanese business culture

3. Due to the existence of a distinctly Japanese M&A advisory business, individual entrepreneurs have difficulty getting connected to SMEs with larger scale

Having recognized these issues, the Growthix Group developed a “Japanese-style search fund” tailored to Japanese culture in order to contribute to solving the business succession issues in Japan. In this context, Growthix has defined “NextPreneurs (searchers)” as the people who, rather than launching new businesses from scratch, take the reins of existing businesses to become the next generation of SME managers.

At NextPreneur University we support not only MBA graduates, but also a diverse group of talent to become the NextPreneurs (Next Generation Entrepreneurs). With Growthix Capital making the referrals to companies that lack successors, and Growthix Investment creating / managing funds to enable the acquisition, we can optimize the searching process for the NextPreneurs and enable them to carry out their search for a company to succeed while simultaneously remaining in their already-established occupations.

The three pillars of the Growthix Group work together to realize the “Japanese-style search fund” model and establish the ecosystem needed to support search funds in Japan.

Mission

Creating a prosperous world through a sustainably circulating capital structure

Vision

Building relationships with stakeholders that last the next century

Constructing a financial system to promote the circulation of capital

Providing continuous learning opportunities for business owners and executives

Growthix Group ESG Initiatives

The Growthix Group is committed to the following ESG initiatives.

- 1.Spreading ESG management among SMEs

- 2.Increasing the strength and resilience of the companies we invest in by integrating ESG management

- 3.Raising next-generation successors (NextPreneurs) through ESG education

*In our “ESG education,” we develop candidates to the point where they not only understand ESG thinking but are able to put it into practice in their management.

We also recommend that the services of the companies being invested in by the search funds are in line with the Sustainable Development Goals (SDGs).

These activities embody our mission of “Establish a prosperous world through a sustainably circulating capital structure”

Small and medium-sized enterprises account for 99.7% of companies in Japan and are indispensable to Japan’s economy since they play a big role in the supply chain of each industry. However, for these smaller businesses, the crisis of survival is close at hand. METI (Ministry of economy, trade, and industry) has announced that 1.27 million small and medium-sized companies will be dealing with succession issues by the year 2025*.

Driven by our corporate mission to “Create a prosperous world through a sustainably circulating capital structure” the Growthix Group is committed to taking on social issues, including the problem of business succession. Being the only company in Japan that provides comprehensive support for search funds, we are determined to continuously create and offer sustainable business solutions.

The support we provide to search funds is not only intended to solve succession issues around the world, but it also takes business succession as a point of opportunity to accelerate the integration of ESG and SDGs thinking into the investee company as well.

Moreover, in order to support these activities, we will continue to strengthen and reinforce the human capital, services, and management infrastructure at Growthix. We will regularly monitor the progress of ESG and SDGs initiatives and challenge ourselves to implement new initiatives through transparent discussions throughout the organization.

*From Current State of M&A and its Issues at SMEs and Small Businesses

Fund of Search Fund Initiatives

Growthix Investment Co.,Ltd. has guidelines to help ensure investments are made in line with the ESG investment standards and also to promote ESG management at our investee companies after investments are made.

We believe that by incorporating the ESG investment standards into our strategy enables Growthix to identify new risks and opportunities well before they realize and lead to building more resilient portfolio that have better long-term performance.

As more investors have included “sustainability” as a key factor for their investment decisions, we believe that having ESG at the core of our investment strategy enables Growthix and our investors to secure profitability while contributing to the creation of a more sustainable society and economy.

At Growthix, we are confident we possess a model that would revolutionize historical investment methods which leads to the maximization of both social utility and profitability.

Initiatives at NextPreneur University

NextPreneur University teaches ESG management in a practical manner.

Since the graduates acquire deep knowledge of ESG management and how to incorporate ESG into daily operations, both NextPreneurs (next-generation entrepreneurs) as well as our shareholders are able to understand that the pursuit of ESG management and profit maximization are not mutually exclusive. This enables both business management team as well as investors to draw the business growth strategies with this consensus in mind.

We recognize that to distinguish ESG from CSR, it requires a realistic perspective that drives the maximization of profit but at the same time incorporates ESG into the business itself. This not only provides profit to our investors but also enables us to continuously invest back into society which leads to our realization of our mission as well.

In determining whether or not ESG management is being effectively practiced, we implement non-financial targets, measure the results, and define penalties and rewards accordingly. By implementing compensation & benefit systems that reflect the process and result of ESG management being executed, we ensure that ESG management is not a business target or a philosophy, but is rather deeply embedded into day-to-day operations and tasks.

How ESG initiatives relate to Growthix’s mission

Once NextPreneurs complete their mission of successfully increasing the value of the inherited company through ESG management. They would then exit the company and become the next search fund investors who hold the strong mindset of ESG investment. Our mid-term objective is to form a financial ecosystem that perpetually supports economic growth through the creation and collaboration of NextPreneurs and Search Fund Investors with the understanding of the importance of ESG.

The creation of this cyclical capital structure and the growth of these successors are the embodiment of the philosophy contained in Growthix’s mission of “ Creating a prosperous world through a sustainably circulating capital structure”

SDGs initiatives

Growthix endorses search funds investments that are targeted towards businesses that share the values represented under SDGs. Furthermore, even if the company we invest in is inadequate in this regard at the time of investment, we proactively influence and encourage the reformation of the business entity to achieve sustainability and a positive impact to society.

Of the 17 goals and 169 targets of the SDGs, we primarily aim to be a company aligned with the following items.

-

4.4

By 2030, substantially increase the number of youth and adults who have relevant skills, including technical and vocational skills, for employment, decent jobs and entrepreneurship

-

8.1

Sustain per capita economic growth in accordance with national circumstances and, in particular, at least 7 per cent gross domestic product growth per annum in the least developed countries

-

8.2

Achieve higher levels of economic productivity through diversification, technological upgrading and innovation, including through a focus on high-value added and labour-intensive sectors

-

8.3

Promote development-oriented policies that support productive activities, decent job creation, entrepreneurship, creativity and innovation, and encourage the formalization and growth of micro-, small- and medium-sized enterprises, including through access to financial services

-

8.4

Improve progressively, through 2030, global resource efficiency in consumption and production and endeavour to decouple economic growth from environmental degradation, in accordance with the 10-year framework of programmes on sustainable consumption and production, with developed countries taking the lead

-

8.8

Protect labour rights and promote safe and secure working environments for all workers, including migrant workers, in particular women migrants, and those in precarious employment

-

8.9

By 2030, devise and implement policies to promote sustainable tourism that creates jobs and promotes local culture and products

-

8.10

Strengthen the capacity of domestic financial institutions to encourage and expand access to banking, insurance and financial services for all

-

17.16

Enhance the global partnership for sustainable development, complemented by multi-stakeholder partnerships that mobilize and share knowledge, expertise, technology and financial resources, to support the achievement of the sustainable development goals in all countries, in particular developing countries

-

17.17

Encourage and promote effective public, public-private and civil society partnerships, building on the experience and resourcing strategies of partnerships

CEO’s Message

Having M&A advisory services as one of the main pillars of the company, Growthix has daily touchpoints with owners and presidents of small and medium-sized enterprises in Japan that need ESG management. This is precisely why Growthix, which provides search fund support in the private financial industry, is capable of being a leading figure in the spread of ESG management.

In order to tackle the social issue of information gap and to promote ESG management throughout society, the most important thing is to be connected with the people who have the power to lead the charge.

Looking back historically, renaissances and paradigm shifts did not come from a top-down approach but were rather a result of the unyielding voices from citizens and private sectors, demanding change.

Today, we are on the verge of a major transformation from old-style capitalism based on the Anglo-Saxon model to a new form of capitalism. Each employee at Growthix has a very large role to play, and as a leading company in this field, we as a company intend to work diligently with pride and a high sense of responsibility.

Growthix Group

Growthix Capital is one of Japan’s largest independent M&A firms and since our establishment in 2019, we have advised on numerous mergers and acquisitions across industries. Having access to a large network of potential successors, Growthix Capital enables the most optimal M&A matching not only to corporate entities, but also to individual successor candidates as well. Moreover, since Growthix provides dedicated teams for each industry, we are able to make proposals exhibiting industry-specific expertise.

Company Name

Growthix Capital Ltd.

Head Office Location

5F Tokyo Central Place, 22-6 Nihonbashi Kabuto-cho, Chuo-ku, Tokyo

Establishment

May 7, 2019

CEO

Mitsuo Nakajima

Growthix Investment is a dedicated private equity fund strategically focusing on the enablement of the Search Fund Framework within the Japanese market. With an investment track record in a broad range of industries, we have a proven record of increasing the value of the companies in which we invest in. By implementing ESG investment standards, we not only maximize the return on investment, but also solve social issues and commit to creating a lasting impact for the future of Japan. As search fund managers, we construct flexible investment schemes and maximize value for each of the stakeholders involved: business owners, successors (NextPreneurs), and both global and local investors.

Company Name

Growthix Investment Ltd.

Head Office Location

6F Tokyo Central Place, 22-6 Nihonbashi Kabuto-cho, Chuo-ku, Tokyo

Establishment

June 1, 2021

Managing Director

Natsuki Okui

Tomohiro Takeuchi

NextPreneur University is a one-of-a-kind business school that seeks to cultivate and produce the next-generation entrepreneurs (i.e., the “NextPreneurs” or searchers) who will inherit and carry-on businesses. We support our students on the road to management by providing a curriculum tailored for developing SME management, conducting on-the-job training, and matching them with companies that lack successors. Even after the business succession has been accomplished, the community of NextPreneur alumni and lecturers continues to serve as an intellectual home for the graduates – a place to which they can return and exchange opinions with their peers to maximize the corporate value they now carry forward.

Company Name

Association for Nextpreneur

Location

Tokyo School Office:

Tokyo School Office:

6F Tokyo Central Place, 22-6 Nihonbashi Kabuto-cho, Chuo-ku, Tokyo

Osaka School Office: :

Message Umeda Building 1F, 2-16-19

Sonezaki, Kita-ku, Osaka-shi, Osaka

Okinawa School Office: :

1F Sun Green Building, 1-16-9 Tsuji, Naha City, Okinawa

Establishment

September 1, 2020

Representative Director

Kazuma Kawamoto